An HSA is a special account where you can save money for medical, prescription, dental and vision needs.

It’s only available with a high-deductible health plan, like the Silver option.

A Health Savings Account (HSA) is a tax-advantaged account where you save money to pay qualified healthcare expenses, as defined by the IRS. Qualified expenses include medical, prescription, dental and vision costs for yourself and your dependents covered under the HDHP.

Employee only coverage: $4,250

Family coverage: $8,500

The company-set limits are within IRS guidelines and allow a $50 cushion for amortized paycheck deductions.

We describe an HSA as “triple tax-advantaged” because it saves you money on taxes in three ways.

1

are pretax (so your gross pay is lower for tax purposes, too)

2

accrues untaxed

The HSA has great tax advantages like a 401(k), in addition to the following features:

|

You earn interest Your account balance grows until you spend it |

Contribution |

|

Interest |

|

Interest on interest |

|

Rollover feature Your balance rolls over year-to-year with no “use it or lose it” rules |

HSA balance |

|

Change Jobs |

|

Retire |

|

Investment options HSA funds can be invested to grow your savings for the future, including retirement |

HSA funds |

|

Mutual funds |

|

Future savings |

And there’s another advantage of an HSA: you never lose it. The balance rolls over year to year, and you can even take it with you if you leave the company or retire.

1

to pay your deductible and coinsurance

2

for planned or unplanned future healthcare needs–the balance rolls over year to year

3

with interest or through investment options—to use in retirement

The Silver option is a high-deductible health plan or HDHP. An HDHP is consumer-driven, meaning that you, as the consumer of healthcare, have the authority to direct your own care. Check out this general comparison of healthcare options.

|

Preferred provider (PPO) |

High Deductible (HDHP) |

|

|---|---|---|

|

PREVENTIVE CARE COVERED 100%? |

|

|

|

HAS AN ANNUAL DEDUCTIBLE? |

|

|

|

HAS AN ANNUAL OUT-OF-POCKET MAXIMUM? |

|

|

|

OUT-OF-NETWORK COVERAGE? |

Usually; often at a higher |

Yes, but at a higher |

|

REQUIRES A COPAYMENT WHEN YOU SEE A PROVIDER? |

|

|

|

CAN USE A HEALTH SAVINGS ACCOUNT (HSA) TO PAY FOR CARE (DEDUCTIBLE AND COINSURANCE)? |

|

|

1

In a traditional PPO you pay a copayment to see a provider, whereas in the Silver option HDHP, you pay all of your cost of care out of pocket until you reach the deductible.

2

In both options you pay 20-30% of your care in coinsurance after you meet the deductible (in-network). If you plan ahead to save money in your HSA per paycheck, you can be ready if high healthcare costs hit.

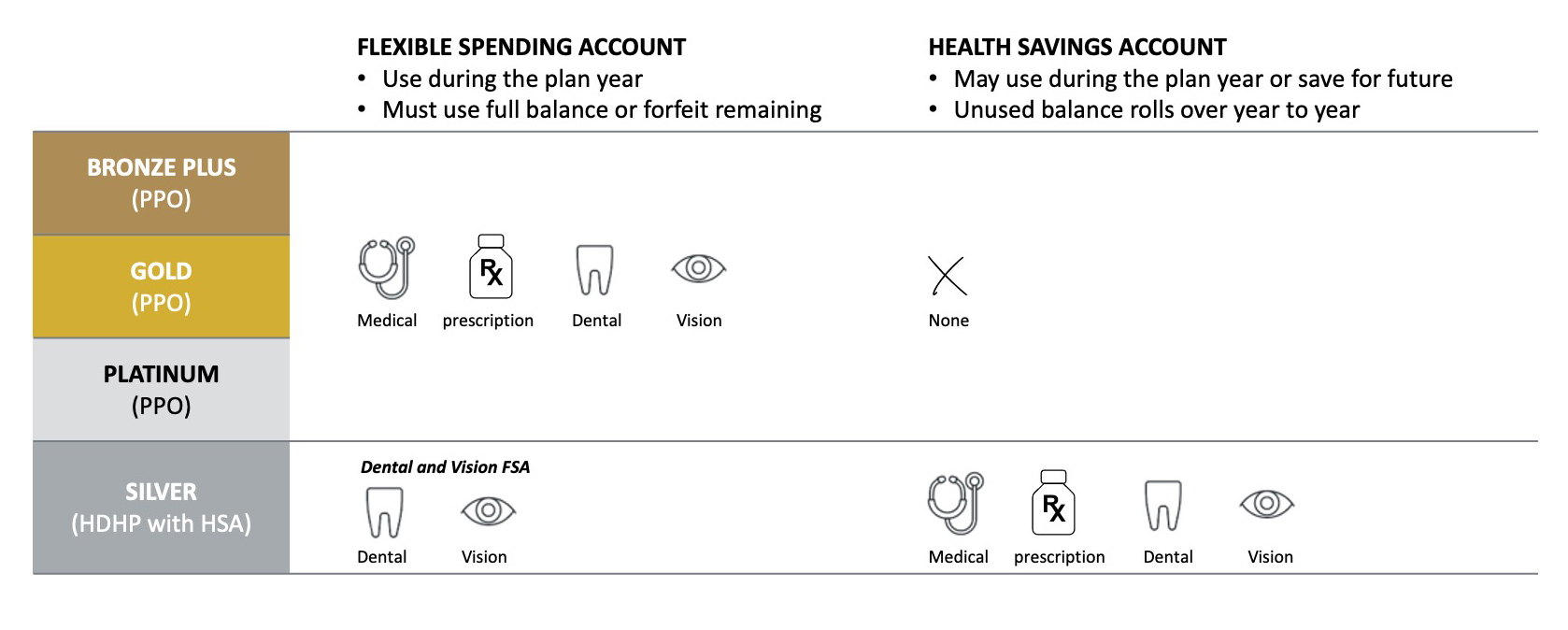

Sometimes all of these names and abbreviations might seem like alphabet soup. But Health Savings Accounts (HSAs) and Healthcare Flexible Spending Accounts (FSAs) are both important pretax savings accounts, and it’s worth understanding both of them. You may choose one or both—did you know they can work together?

You can contribute to both of these accounts on a pretax basis. But, bottom line, if you’d like to have an HSA, you must choose the Silver option. This is the only option that meets the IRS’ qualification of being a high-deductible health plan (HDHP). If you choose the Silver option, you may also open a Dental and Vision FSA—because you’ll use your HSA for medical and prescription expenses.

|

Health Savings Account |

Dental and Vision Flexible Spending Account |

|---|---|

|

Available to those who are enrolled in the Silver medical option, a high-deductible health plan—this is an IRS rule.

|

Available to those who are enrolled in the Silver medical option, a high-deductible health plan—this is an IRS rule.

|

|

Qualified expenses for the HSA include medical, prescription, dental and vision costs for yourself and your dependents covered under the Silver option. |

Qualified expenses for the Dental and Vision FSA only include dental and vision costs for yourself and your covered dependents. |

As you can see, the accounts are a lot alike but are very different, too.

Keep these options in mind as you plan ahead for your healthcare needs.

Don’t let the opportunity to save pretax money pass you by!

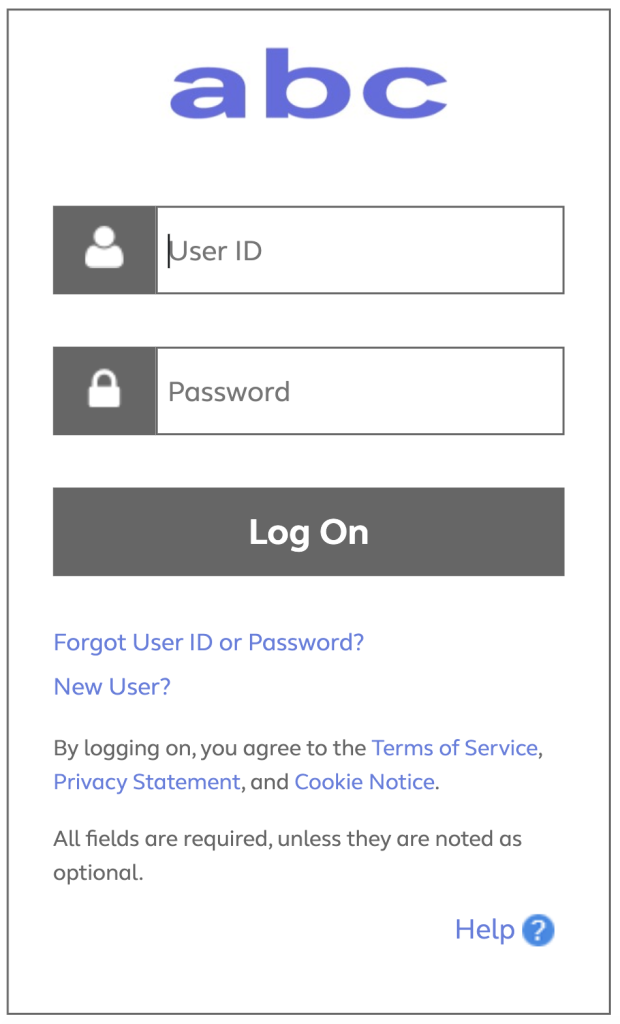

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.