Accidents can happen any time, and treatment can knock a household budget off course. With MetLife Accident Insurance, you’ll receive a cash benefit paid directly to you, not your healthcare provider, so you can use the money however you want. This benefit is in addition to any costs that your medical plan may pay.

For more information, visit Homebase.

Getting a diagnosis for a critical illness can take you by surprise. With MetLife’s Critical Illness Insurance, you’ll receive a lump sum payment of $7,500 to $30,000 to help offset expenses for ongoing treatments or medical needs. Critical Illness Insurance includes coverage for illnesses like cancer, end stage renal disease, heart attack or stroke, and more.

For more information, visit Homebase.

Hospitalization can be expensive and have a big impact on your life. Hospital Indemnity Insurance provides a direct lump-sum payment—one convenient payment all at once—if you or a family member is hospitalized.

For more information, visit Homebase.

Attorney fees that are billed by the hour can add up quickly. MetLife Legal Plan provides you with cost-effective access to qualified attorneys who can represent you, your spouse and dependents.

You get consultations by phone or video for an unlimited number of matters with an in-network attorney. Relevant life events for which you might need legal guidance include, but are not limited to, divorce, family care-giving, reproductive issues, traffic citations and moving violations, legal action, end of life planning, special needs trusts, and buying or selling a house or other property. In the case of reproduction, you receive 20 hours of legal assistance with the process of surrogacy; egg, sperm, gamete, or embryo donation; and/or embryo adoption. During the consultation, the attorney will review the law, discuss your rights and responsibilities, explore your options, and recommend a course of action.

Enroll in legal protection during your new hire benefits enrollment or during Open Enrollment. Call MetLife Legal Plans at 800.821.6400 with any questions.

The legal plan provides full coverage of attorney fees for common personal legal matters with no addition out-of-pocket cost to employees.

|

Money Matters |

|

|

|

|

Home & Real Estate |

|

|

|

|

Estate Planning |

|

|

|

|

FAMILY & Personal Including but not limited to |

|

|

|

|

Civil Lawsuits |

|

|

|

|

Elder-care Issues |

Consultation & Document Review for Issues Related to Your Parents:

|

|

|

|

Traffic & Other Matters |

|

|

|

|

Additional Features |

Telephone advice, office consultations, demand letters and document reviews on an unlimited number or personal legal matters. |

||

|

For non-covered matters that are not otherwise excluded, employees get four additional hours or network attorney time and services per plan year. |

|||

|

Family First – Caregiving Services The member and their family is provided a highly-trained care team expert to help navigate whatever caregiving challenge they may be facing or that may arise. |

|||

|

Reduced fees for personal injury, probate and estate administration matters, provided by network attorneys. |

|||

|

Access to digital estate planning solution for wills, living wills, power of attorney and living trusts. |

|||

Help safeguard your personal information—it’s everywhere! Scams, phishing, hacking, and plain old identity theft are on the rise. Norton LifeLock provides a comprehensive, proactive identity theft and recovery service.

Get the all-in-one protection for your identity and devices.

Enroll in Identity Theft protection during your new hire enrollment or during Open Enrollment.

Get employee rates with an option for payroll deductions on auto and home insurance. Receive competitive quotes from Farmer’s Insurance and other carriers all on one platform. Visit farmersinsurancechoice.com/Asurion to get started.

Note: Farmer’s Insurance is a MetLife brand.

Get health protection for your pet with pet insurance from MetLife, which includes a variety of enhanced coverage options. You can use any licensed veterinarian, and even choose preventive care and discounts. Visit metlife.com/getpetquote to enroll at any time during the year.

Asurion provides you with perks and discounts to stretch your hard-earned dollars on everyday products and services like theater tickets, transportation, gym/fitness studios, theme park attractions, everyday necessities, and much more. You can also take part in monthly giveaways for cash, movie tickets, electronics and other prizes.

Click here to register using your Asurion email address and your Employee ID (six-digit number located by your name in Workday). Start saving money today!

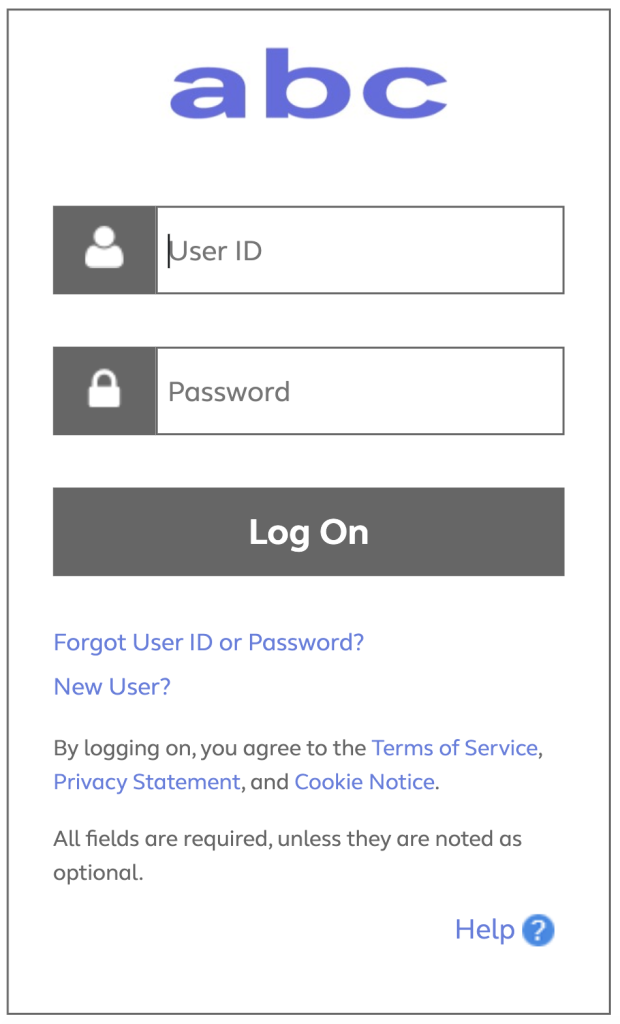

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.