Your decision shouldn’t just be based on premium cost.

In fact, there are three components of healthcare cost you should consider before choosing an option.

|

Did you see your doctor only for a preventive exam? Then you might be able to get away with the lowest paycheck deductions. Do you have multiple dependents who could have high healthcare needs? You might want to consider a lower–risk plan with higher paycheck deductions. Higher coverage at the point of service equals higher paycheck deductions. |

The best way to budget for future healthcare needs is to look at your healthcare expenses from the previous year. When you use your medical coverage, you have to meet your option’s deductible before the option shares cost. After you meet the deductible, you pay a percentage of the cost—coinsurance—until you reach the option’s annual out-of-pocket maximum. At that point your financial responsibility is satisfied for the year. |

Most people don’t think about unforeseen healthcare incidents—but they happen! And if you experience one before you meet your deductible, you may end up with a large medical bill. Good news! Asurion offers a couple of pretax savings accounts for healthcare needs: a flexible spending account (FSA) or a Health Savings Account (HSA), which is available with the Silver option. |

|

1 Your premiums, i.e. per-paycheck cost |

2 Your deductible + coinsurance = your share of the cost of care |

3 Your healthcare savings |

|---|

|

Bronze Plus |

Gold |

Platinum |

Silver |

|

|---|---|---|---|---|

|

PREVENTIVE CARE |

100% covered |

100% covered |

100% covered |

100% covered |

|

PREMIUMS Rates depend on ZIP code and coverage level |

$ |

$$ |

$$$ |

$ |

|

COPAYMENT PCP / Specialist |

$30 / $50 |

$25 / $40 |

$25 / $40 |

You pay the cost of visit until deductible is met |

|

URGENT CARE |

$50 |

$40 |

$25 |

None |

|

DEDUCTIBLE Employee only / Family |

$2,300 / $4,600 |

$800 / $1,600 |

$250 / $500 |

$1,700 / $3,400 |

|

COINSURANCE |

30% |

20% |

15% |

25% |

|

Out-of-pocket maximum |

$6,700 / $13,400 |

$3,600 / $7,200 |

$2,300 / $4,600 |

$4,250 / $8,500 |

|

HEALTHCARE ACCOUNTS Flexible Spending Account Health Savings Account |

FSA optional HSA not available |

FSA optional HSA not available |

FSA optional HSA not available |

Dental and vision FSA optional HSA available |

|

PRESCRIPTION Copayment |

||||

|

Tier 1 |

$12 |

$10 |

$8 |

No copayments |

After you’ve chosen a metallic option, you’ll choose an insurance carrier. Your options will vary based on your home ZIP code, but you’re bound to find a carrier that meets your budget and needs. You’ll have a variety of national and regional carriers to consider.

As part of your decision, check to make sure your doctor is in-network with the insurance carrier you’re considering, unless you don’t mind having to switch providers. Depending on the option, you may pay 20-30% more to use an out-of-network provider. In addition, your in- and out-of-network deductibles accrue separately. For lowest cost, you should always choose in-network providers.

Visit the insurance carrier member pages on Asurion Benefits Central for more information about these and regional options.

|

Aetna |

Anthem |

CignA |

Unitedhealthcare |

|

|---|---|---|---|---|

|

Available in all states |

|

|

|

|

|

Claims advocacy support |

|

|

|

|

|

Fitness center discounts |

|

|

|

|

|

Doctor’s office visits |

|

|

|

|

|

Infertility care coordination |

|

|

|

|

|

Mobile app |

|

|

|

|

|

Nutrition program discounts |

|

|

|

|

|

Special needs care coordination |

|

|

|

|

|

Telemedicine |

|

|

|

|

|

Gender Affirming Care Coordination |

|

|

|

|

You may notice some carriers have lower or higher premiums than others. Each carrier is different and offers their own price for each option and coverage level. They also have their own network of providers.

What’s not different are the medical options. The insurance carriers offered to you will cover the benefits of the medical options in the same way.

You can compare the details when you enroll online, to see which carrier is offering you the best deal.

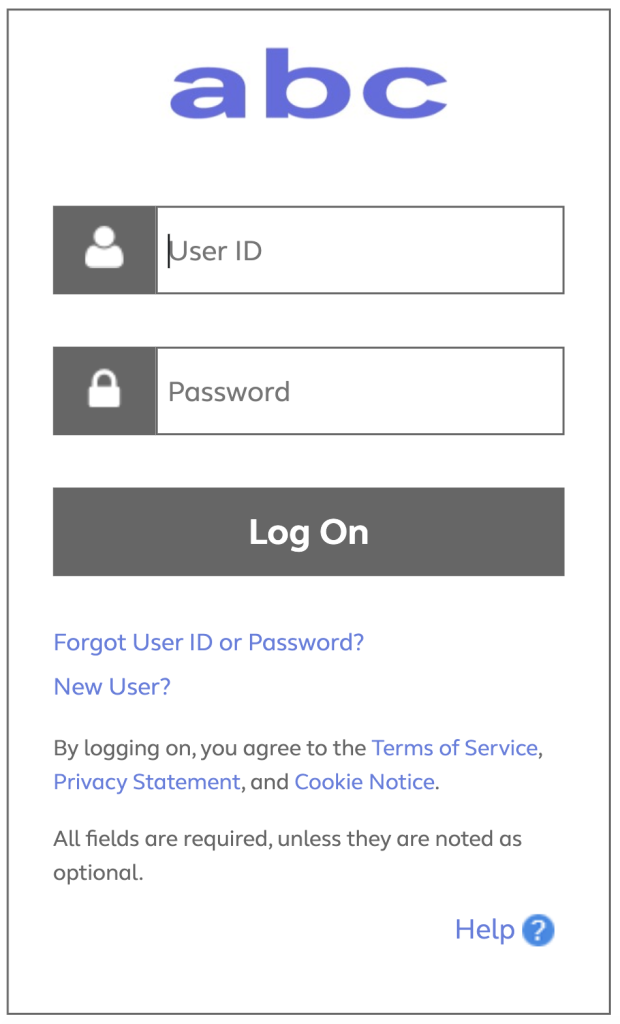

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.