It’s important to understand some basics.

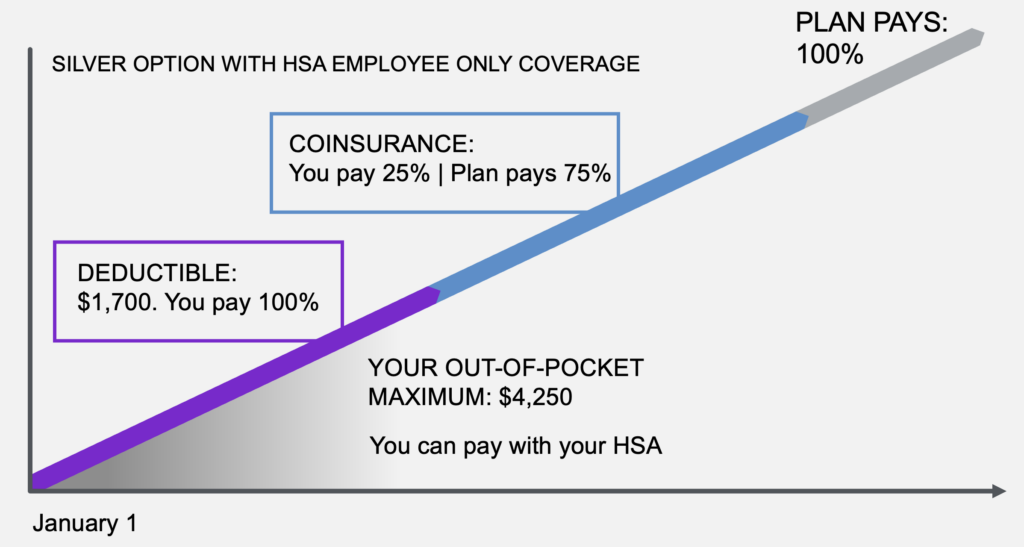

In the example below, if you start at the left side of this chart, that’s where you’re at on January 1. You have to meet the deductible of $1,700—with Employee only coverage—before the plan starts sharing 75% of your cost. After you reach the out-of-pocket maximum of $4,250, the plan pays 100% of the remaining cost. This illustrates the Silver option, but the relationship between the deductible and coinsurance is the same for all the metallic options.

Graphic represents the Silver option with employee only coverage. Bronze Plus, Gold and Platinum options have different deductibles and coinsurance and work a little differently. For one thing, the HSA is available only with the Silver option. An FSA can cover qualified expenses in the other options.

Your deductible is typically a flat dollar amount of healthcare expenses that you pay out of your pocket. For the Silver option, this is the amount of cost you cover before your insurance begins to pay. (If you have a family, you must meet the Family deductible before coinsurance begins. This is called a “True Family” deductible.) Be aware that in- and out-of-network expenses accrue separately.

Your deductible (and coinsurance) cover the cost you see—in other words, the part of your healthcare costs that is passed on to you. While Asurion continues to cover the majority of employee healthcare costs, each covered individual has a responsibility to use our benefits in the smartest way possible. Note that premiums and copayments do not count toward the deductible.

The amount of your in-network deductible depends on the option you choose:

|

Employee Only |

Family |

|

|---|---|---|

|

Bronze Plus |

$2,300 |

$4,600 |

|

Gold |

$800 |

$1,600 |

|

Platinum1 |

$250 |

$500 |

|

Silver |

$1,700 |

$3,800 |

When your covered healthcare expenses exceed the deductible, you and the plan begin sharing the cost by paying a percentage called coinsurance. Your deductible and coinsurance cover the cost you see—in other words, the part of your healthcare costs that is passed on to you. While Asurion continues to cover the majority of employee healthcare costs, each covered individual has a responsibility to use our benefits in the smartest way possible.

Your percentage of in-network coinsurance depends on the option you choose:

|

Bronze Plus |

30% |

|

|

Gold |

20% |

|

|

Platinum |

15% |

|

|

Silver |

25% |

|

The out-of-pocket maximum is the total amount you could pay within a plan year for medical care and prescriptions. It does not include premiums taken out of your paycheck for health coverage. If you reach this maximum during the plan year, the plan pays 100% of covered services for the rest of the plan year.

|

Employee Only |

Family |

|

|---|---|---|

|

Bronze Plus |

$6,700 |

$13,400 |

|

Gold |

$3,600 |

$7,200 |

|

Platinum |

$2,300 |

$4,600 |

|

Silver |

$4,250 |

$8,500 |

Copays (short for “copayments”), are a fixed amount for a covered service collected when you see your provider, unless you have the Silver option. Copays do not count toward the deductible or out-of-pocket maximum.

Your copays depend on the option you choose:

|

PCP (Primary Care Physician) |

Specialist |

Urgent Care |

|

|---|---|---|---|

|

Bronze Plus |

$30 |

$50 |

$50 |

|

Gold |

$25 |

$40 |

$40 |

|

Platinum |

$25 |

$40 |

$25 |

|

Silver |

100% of cost of care until you meet deductible |

||

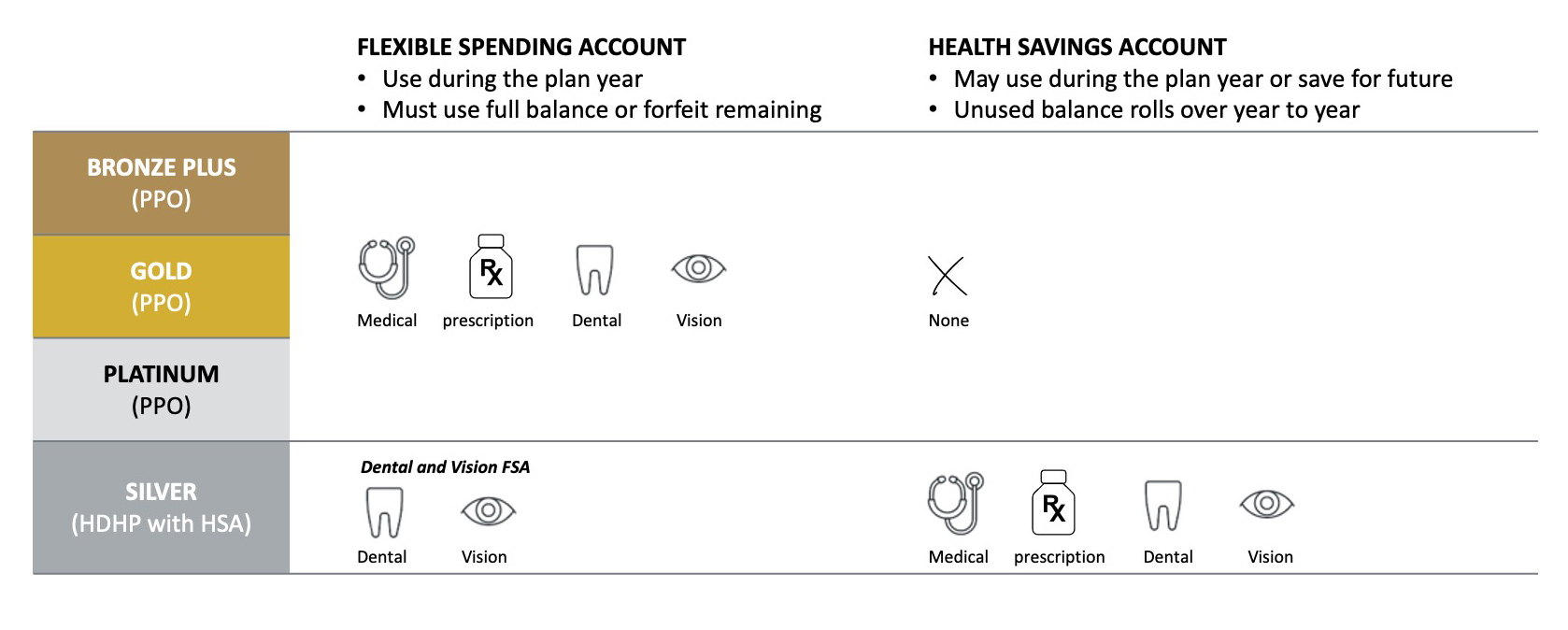

Health Savings Account (HSA)

If you are in the Silver option, you can pay your deductible and coinsurance using an HSA. You make contributions to the account through payroll deductions. Unlike a Flexible Spending Account, you don’t lose the money in your account from year to year.

Save for your out-of-pocket expenses pretax

Earn money on your savings pretax

Pay your expenses pretax

Keep your money

Healthcare Flexible Spending Account (FSA)

If you have the Bronze Plus, Gold or Platinum option, you can pay with a healthcare Flexible Spending Account. You can also pay with your personal debit or credit card. It’s important to note that in- and out-of-network deductibles and out-of-pocket maximum amounts accumulate separately.

Using in-network providers is a smart strategy for keeping your healthcare costs as low as possible. If you do choose to use out-of-network providers, be aware that in-network and out-of-network costs accumulate separately, and you will probably pay more out of pocket to meet both the in- and out-of-network deductibles.

Out-of-network providers are not held to the same pricing guidelines as in-network providers. They can charge whatever they want, even if a fee for a common service is well above average for the area. The reimbursement for out-of-network providers is a lower percentage AND the insurance carrier will only pay what they consider to be reasonable and customary. As a result, you end up paying even more out of pocket because out-of-network doctors will bill you for the cost difference that insurance doesn’t cover.

Asurion offers voluntary benefits to round out your coverage. These options are terrific if you want coverage “just in case” an unexpected event comes your way, instead of buying more expensive insurance (over-insuring) for yourself and your family. Learn more about Accident, Critical Illness and Hospital Indemnity voluntary coverage options to supplement medical coverage.

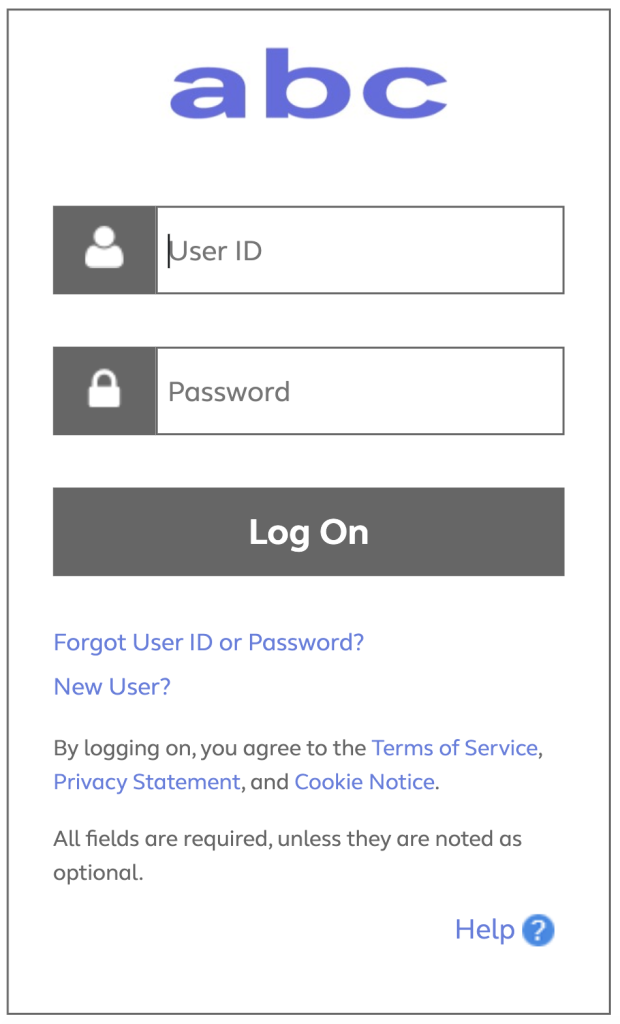

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.