The names “Accident, Critical Illness and Hospital Indemnity Insurance” make most people think these optional coverages round out your medical insurance plan. Actually, these three provide a cash payment should you or a covered dependent suffer a condition as defined by the plans. Click the links above to learn more.

You have basic Life and Accidental Death and Dismemberment insurance provided by Asurion, as well as buy-up coverage options. You also may choose group universal life insurance coverage with a long-term care provision. Click the link above to learn more.

Short-term and long-term disability insurance replaces a portion of your income while you are recovering from an illness or injury.

Asurion provides core STD and LTD automatically to eligible employees. You have the option to purchase additional disability protection during your benefits enrollment as a new hire, or during Open Enrollment. If you have five years of service, you are automatically enrolled in the STD and LTD Buy-up options at no cost to you.

|

Percentage of base pay |

|

|---|---|

|

Basic STD |

50%, up to $5,000 per week |

|

STD Buy-up |

70%, up to $7,000 per week |

|

Percentage of base pay |

|

|---|---|

|

Basic Ltd |

50%, up to $20,000 per week |

|

Ltd Buy-up |

66-2/3%, up to $20,000 per week |

Learn more about how to submit a disability claim on Homebase > Pay & Benefits > Short and Long-term disability.

Save for retirement and get a company match through the Asurion 401(k) savings plan.

You can contribute pretax dollars to a traditional pretax 401(k) or an after-tax Roth up to IRS limits.

As a new hire, you’re automatically enrolled at 3% of your pay once you’ve met the eligibility requirements. After your first year of service, Asurion will match 100% for the first 3% of your contribution and 50% on the next 2%.

You can make changes to your contributions anytime and you’re always 100% vested in your contributions and company match contributions.

Visit www.principal.com or call 800.547.7754 to:

Because planning for retirement requires an individualized approach, Asurion has engaged financial planners to help guide you toward the saving and investing approach that’s uniquely right for you. Take advantage of one-on-one virtual meetings with a retirement expert and helpful online resources all at no cost to you.

Want to learn more about financial topics that are of interest to you?

Go to principal.com/Milestones.

Sign up for a virtual 1 on 1 meeting.

Visit principal.com/Virtual1on1 to get started.

Asurion has partnered with Alliant Credit Union to offer you the perks of an online credit union membership.

Benefits include:

Learn more and enroll by visiting AlliantCreditUnion.com/Asurion or call 800.328.1935.

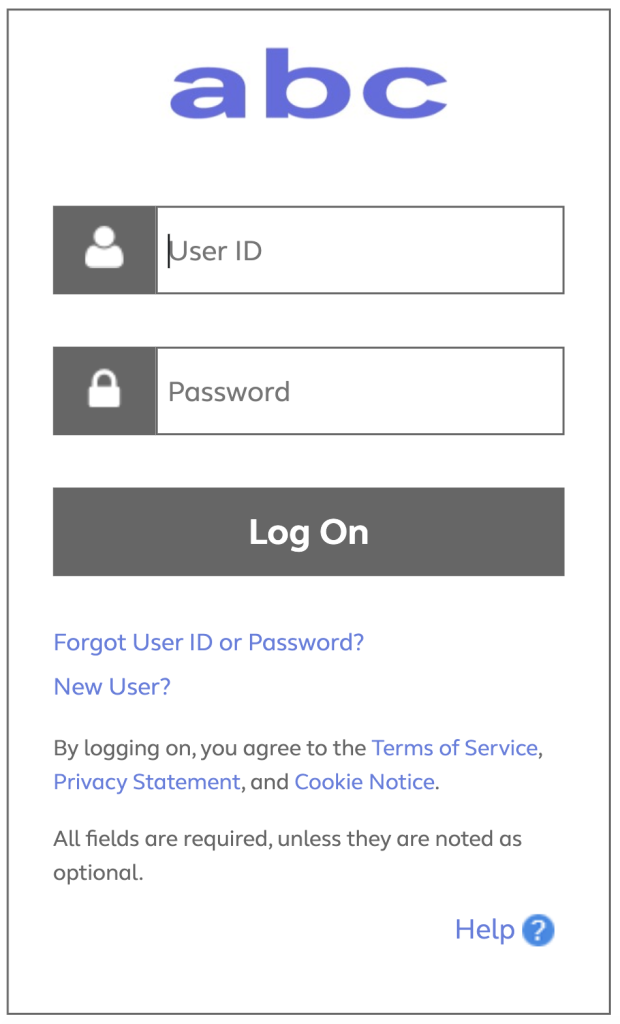

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.