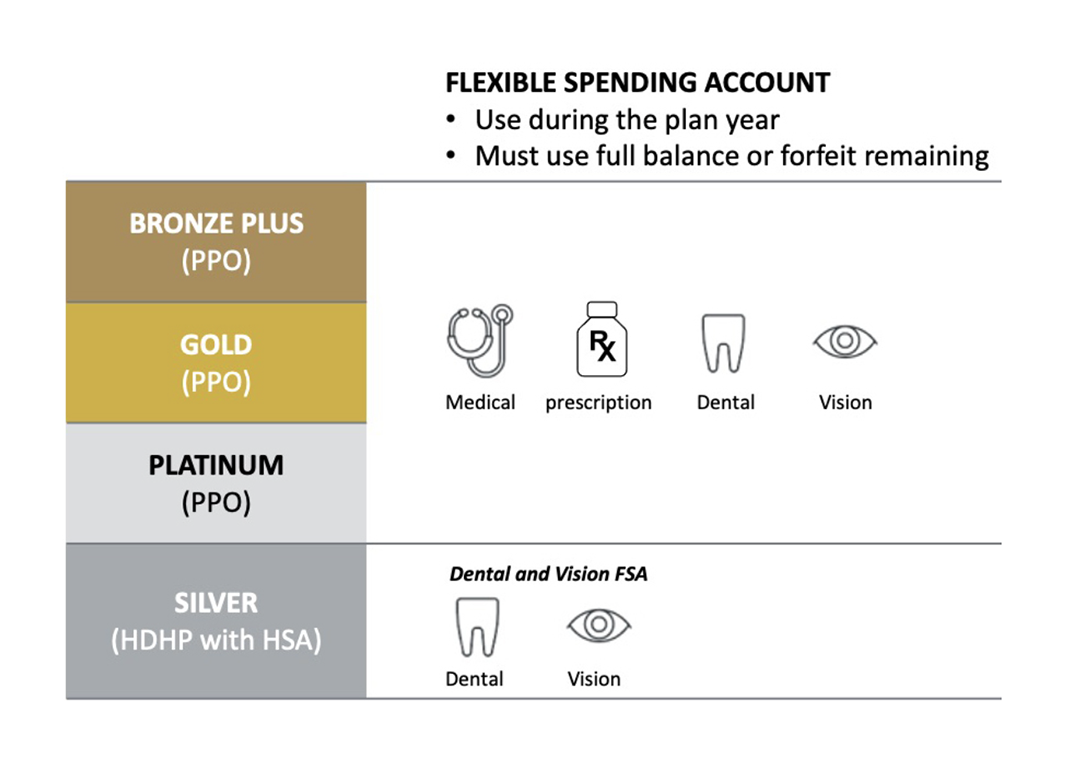

If you’re enrolled in the Silver option, you can contribute pretax money to a Dental and Vision FSA. It works like the Healthcare FSA, but you can only use it for qualified dental and vision expenses.

Save money to cover child and elder care expenses through convenient pretax payroll contributions throughout the year.

You can make pretax contributions to a special savings account that you can use to pay for preschool, summer day camp, before or after school programs, and child or adult daycare. We call it the Dependent Daycare FSA. You may save up to $5,0001 and you must use 100% of the money you save before the IRS-required deadline, or you’ll forfeit any remaining balance.

One word of caution: Unlike the Healthcare FSA, you have to save money before using your account balance to pay for expenses. Until you get enough saved up to pay a bill, you’ll have to cover the cost out of pocket while saving pretax money in this account. Then you can reimburse yourself. If you’re concerned that this may be too difficult, this FSA may not be the savings vehicle for you.

1Married individuals who file separate tax returns may each save $2,500.

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.