Until recently, Nadia lived with her older sister. When she found out she was pregnant, she decided to move to her own apartment down the hall so she and her baby would have more room and not disturb her sister’s family. At least she’ll still be close enough to share babysitting favors—and the occasional wardrobe necessity, just like when they were kids.

During her new hire enrollment Nadia elected the Bronze Plus option. She knew she needed healthcare coverage, but because she’s young and healthy, she didn’t really think beyond that. Since she’s preparing to become a mother, she wanted to compare her options more closely.

While binging reruns of “Say Yes to the Dress!” one Saturday, Nadia started scrolling through the ABC InfoShare on her phone. She noticed that the premiums for the Bronze Plus and Silver options are similar, but the deductible for the Silver option is a little lower. Plus, when she looked into the Health Savings Account that’s only available with the Silver option, she thought it would be a smart way to plan ahead for healthcare needs without paying for coverage she doesn’t use. Because she’s having a baby, she also enrolls in Hospital Indemnity to be paid for the days she’ll be in the hospital giving birth.

It’s not easy to manage all the changes life is bringing to Nadia, but she knows that the decisions she makes today will impact her life into the future. With about six months until her baby arrives, she has time to save her money and practice living by a strict budget. Her sister is always nearby to help out if she gets into a bind, but Nadia wants to prove to herself and her sister that she can be responsible and build a life for herself. She wants to take full advantage of the good job with competitive benefits she has through Asurion because she knows that life is no longer just about her!

Gabby joined Asurion after graduating from high school. Since she enjoys interacting with people, she’s a great fit for the customer service environment of Soluto.

A healthy non-smoker, Gabby and her toddler son live with her parents since Gabby is still pursuing her bachelor’s degree part-time.

Which of the low-premium options should Gabby choose for next year, the Bronze Plus option or the Silver option?

Since her son is under a doctor’s care for asthma, he sees his pediatrician regularly and Gabby always takes advantage of free preventive care.

Last year Gabby signed up for the Silver option, but realized that the up-front out-of-pocket expenses to meet the deductible made it difficult to maintain her tight budget.

Using the ABC InfoShare, Gabby sits down with her mom to talk through how she used her coverage this year and to show her the plan comparisons.

Gabby attends a Rock’N Enroll Zoom meeting to learn from her Asurion Benefits Team firsthand and discovers the difference between a preferred provider organization (PPO) and a high-deductible health plan (HDHP).

Then Gabby logs on to Asurion Benefits Central to check prices against her budget.

For now, she chooses the Bronze Plus option. She likes the predictability of the Bronze Plus option in having a copayment when she or her son needs to see a doctor.

She also decides to save $200 in a flexible spending account (FSA) to cover her son’s asthma medications. Gabby decides that when she finishes her bachelor’s degree, she’ll use the money she’s currently paying for her classes to save in an HSA with the Silver option.

Before she confirms her elections, Gabby chooses a dental coverage level, and names her mom as her life insurance beneficiary.

Dawn was recently promoted to manager at the call center where she’s worked for six years, and is described as cheerful and detail-oriented. She enjoys showing new call center employees the ropes almost as much as she enjoys being a foster dog-mom to rescue animals.

Should Dawn stick with the Bronze Plus option for next year, or move to a different option with a lower deductible?

Dawn and her husband, Louis, are non-smokers and they always take advantage of free preventive care. When she was in college Dawn was in a bad car accident, so she understands that she must meet her medical option’s deductible before coinsurance starts.

They’re both relatively healthy and only require occasional over-the-counter medications for seasonal allergies, which can get bad in Nashville.

To double-check her memory of how she used her healthcare coverage, Dawn gathers her medical coverage statements from the past year.

She’d like to have LASIK surgery, and she knows that procedure isn’t covered by vision insurance but can be paid for using funds from a pretax flexible spending account (FSA) or Health Savings Account (HSA).

She reviews all the materials Asurion provides for evaluating her options, then logs on to Asurion Benefits Central to check prices against her budget.

Dawn decides to stick with the coverage level she has: the Bronze Plus option.

She likes paying less out of her paycheck and having a copayment when she sees her doctor.

Dawn also enrolls in Accident Insurance. In case of an accident, Dawn can use the benefit she receives from this voluntary coverage to help her pay the Bronze Plus option’s deductible.

Dawn also puts aside $3,000 in an FSA for the LASIK surgery she wants because this procedure is an eligible expense for her pretax healthcare savings. In addition to dental and vision coverage, Dawn enrolls in pet insurance for her fur babies.nefits she has through Asurion because she knows that life is no longer just about her!

McCrea is a very active person who plays softball in a recreational league every weekend during the spring and summer, is part of a knitting guild that creates scarves and blankets for the homeless in the fall and winter, and also is an active feline foster parent who shares a home with five fur-babies. Their activities make McCrea susceptible to many illnesses that trend throughout the year, most of them being viruses and allergies. So, McCrea regularly gets allergy shots and is a frequent flier at the Minute Clinic.

McCrea likes being able to know the copayment at each office visit. That’s less information to keep in mind for someone with a very busy lifestyle. They also like the fact that the Bronze Plus option has the lowest employee premiums.

When Annual Benefits Enrollment comes around each year, McCrea is one of the first people to go to Asurion Benefits Central and complete the enrollment process. They appreciate all the resources Asurion distributes to help everyone remember, and this year, McCrea even invited the other employees in Asurion’s LGBTQIA+ Resource Group to attend a Benefit Meeting, since the Asurion Benefits Team encouraged everyone to remind a friend at Asurion!

McCrea’s philosophy is, “If it’s not broken, don’t mess it up.” The Bronze Plus option has been working for their lifestyle for several years, so that’s what McCrea will continue to elect. Enrollment is more convenient than ever, now that it can all be done through the Alight Mobile App. Before they sign off, they add Pet Insurance for the fur babies and a flexible spending account for allergy medications.

Before having to cut back his hours to help care for his aging grandmother, Angel was a full-time customer service manager. He’s happy that Asurion offers medical benefits for part-time employees with set fees when he sees a doctor, discounts on other services and reimbursements for some healthcare costs. He’s evaluating the three options to see which one will best suit his needs.

If he only had himself to consider, Angel’s decision might be easier.

He’s pretty healthy, with the exception of high cholesterol, and his side hustle as a preteen rec league soccer coach keeps him in pretty good shape. But, Angel knows his 11-year-old daughter Liliana might come live with him, so he wants to be sure the benefits would cover her needs, too.

While on a flight from Nashville to San Antonio, Angel had time to make some notes about his healthcare history over the past year to help him plan for the upcoming year.

The soccer organization makes sure their employees have flu shots every year. He takes a prescription medication for his cholesterol. And, except for the occasional allergy attack, he and Liliana both avoid doctors’ offices and medications. She did break her arm while she was rollerskating with her cousins when she was five, so Angel knows from experience that kids are unpredictable. He wants to be prepared.

After comparing the Basic, Enhanced and Enhanced Plus PPOs, Angel decides the Enhanced option is his best bet. It provides more coverage toward prescriptions and a higher allowance for urgent or emergency-related health issues.

Paying the premiums through payroll deduction is convenient, and though it will stretch his budget a little, Angel knows an accident or major illness could be catastrophic for him. He’s glad there’s a missed premium forgiveness feature in case he gets behind. Besides that, the fact that providers are paid directly is a huge convenience with everything he’s juggling.

After working in a popular retail chain selling mobile devices, Jeremy made a career transition to join Asurion as a cell phone repair technician. He’s found the hours and benefit options much more suited to his lifestyle. He enjoys coaching his son’s Little League team and serving as “grill master” at his family’s backyard barbecues.

Is the Bronze Plus option or the Silver option better aligned to Jeremy’s family’s situation?

Last year, his son tripped while running bases and needed stitches, so Jeremy understands how healthcare costs are always unpredictable! Jeremy’s wife, Anita, is pregnant with their second child, so they’re trying to decide whether to keep their current medical coverage or switch.

The low deductible of the Gold option is appealing, but the premiums don’t fit their budget. The family has been in the Bronze Plus option, but is comparing it to the Silver option.

Using his medical insurance carrier’s app, Jeremy pulls up all of the explanations of benefits their medical insurance carrier sent to them throughout the year.

He reads through all the materials Asurion provides for evaluating his options, including his Annual Benefits Enrollment brochure and ABC InfoShare.

As he’s reading, he pays extra attention to the subject of Health Savings Accounts (HSA)–how they work, what expenses can be paid, how they’re different from flexible spending accounts (FSA). He also logs on to Asurion Benefits Central to check prices and networks.

In the end, Jeremy and Anita decide they like the predictability of the Bronze Plus medical option’s design: copayments when they see a provider or get a prescription, and coinsurance after they meet the option’s deductible.

They decide to set aside $2,000 through pretax payroll deductions in an FSA to cover half of the Family deductible, a number that looks reasonable based on their current-year medical claims. Jeremy also re-enrolls the family in dental and vision coverage, too.

It’s important that Anita can keep her obstetrician/gynecologist (OB/GYN) and preferred hospital, so before Jeremy confirms his enrollment, he contacts their insurance carrier to make sure. He also adds Hospital Indemnity Insurance to round out his coverage.

Zacchariah started working in his grandfather’s business at age 9, along with his father and brothers. He surprised his family by opting to skip college and instead invest money that he had saved in real estate, which he now does on the side while working for Asurion. With three young sons to support, Zacchariah appreciates the benefits package offered by Asurion.

As a preschool teacher, Zacchariah’s wife, Annelle, doesn’t make a large salary. But, her part-time work frees her up to help manage Zacchariah’s real estate business. Their youngest child was recently diagnosed with autism, so Zacchariah and Annelle have committed themselves to pulling together the resources he might need for the best possible future.

One Saturday evening after dinner, Annelle and Zacchariah logged in to Asurion Benefits Central to compare how they’ve used their healthcare coverage over the years. Because their family is mostly healthy, they haven’t had many high-ticket items to deal with, except for a trampoline accident their oldest son experienced last year, and a short NICU stay for their youngest when he was born four years ago. That child also has chronic food allergies that keep everyone on their toes.

Annelle pointed out that they had paid more in premiums over the last several years than she felt they had used of their pricey medical coverage. She suggested that it would be a wiser investment of their money to save in a Health Savings Account with the Silver option instead. They also added Accident Insurance and Hospital Indemnity Insurance in case they need a bridge until their HSA balance grows enough to cover their deductible. Zacchariah agreed that having an HSA would be a smart thing to use in their retirement years, and they decide to save the annual maximum. He realizes that if the annual maximum is too much for their cash flow, he can change the amount later in the year. He completes their enrollment by adding dental and vision coverage for everyone, as always. With children, you have to cover all the bases.

Margaret went back to work 10 years ago when her youngest child was six. Her husband, Dan, had developed a vision impairment that disqualified him from service as an aircraft mechanic. Dan now manages the children’s activities—two active high schoolers and two school-age foster children.

Is the Silver option still the best choice for Margaret and her family?

When Asurion transitioned to Asurion Benefits Central, Margaret was excited to see that a high-deductible health plan (HDHP) with a Health Savings Account (HSA) was available.

Since she joined the workforce later than others, she has been focused on saving as much money as possible for retirement. She likes the triple-tax savings of an HSA to help her reach her financial goals and plans to continue using the Silver option next year.

Even though Margaret thinks she’d like to stay in the Silver option, she still does her research. She starts by gathering her insurance carrier’s explanations of benefits to recall how her family used their healthcare coverage this year.

Then she reads through all the materials Asurion provides for evaluating her options, such as her Annual Benefits Enrollment brochure and ABC InfoShare.

Before Margaret makes her choices, she logs on to Asurion Benefits Central to check prices and networks.

Margaret re-enrolls in the Silver option. Her family met their $3,000 Family deductible in the Silver option this year, and covered that cost and some coinsurance with their HSA. Margaret has a $900 balance rolling over to next year.

She plans to contribute the $8,250 family maximum to her family’s HSA this year through pretax payroll deductions because she knows her unused balance will earn interest and that she can even save her HSA for healthcare needs in retirement. She re-enrolls in the Silver option and also elects dental and vision coverage. In addition, Margaret adds group universal life insurance to her existing coverage because of the long-term care provision. She’s planning ahead for herself and her husband, who’s already living with a disability.

Margaret is careful with her family’s healthcare spending and looks for ways to keep their costs as low as possible. In fact, telemedicine is Margaret’s favorite feature of the medical option for its convenience and low cost.

Eduardo has been working for Asurion in various California locations since college. He shares custody of his kids with his ex-wife, whose healthcare coverage as a state government employee is more limited for dependents. So, the children are on Eduardo’s current Bronze Plus option through Asurion.

Should Eduardo stick with the Bronze Plus option for next year, or move to the Gold option, which has a lower deductible and coinsurance?

Since both children are now teens and involved in sports year-round, Eduardo has noticed that his family is using their medical coverage more often. Last year his 17 year old broke her wrist playing volleyball, and his 13 year old twisted his knee on the basketball court. Plus, his daughter seems to be following in her father’s footsteps by battling hypertension. They’re both making healthy modifications to their diet and taking prescription medications at the advice of their family doctor.

Eduardo hasn’t smoked for 10 years, and always takes advantage of free preventive care. He knows that a maintaining a healthy lifestyle can help him lower his healthcare costs. He also wants to set a good example for his kids.

To double-check his memory of how he and the kids used their healthcare coverage, Eduardo gathers his family’s medical expenses from the past year.

He knows it’s nearly impossible to predict his kids’ activity-based healthcare incidents, but he’d like to be as prepared as possible because he knows one thing for sure: they’re going to use the coverage.

Eduardo carefully reviews all the materials Asurion provides for evaluating his options, his Annual Benefits Enrollment brochure and ABC InfoShare—then logs on to Asurion Benefits Central to check prices against his budget.

Eduardo decides the low deductible and coinsurance of the Gold option is appealing because he expects high medical costs this year. It has lower premiums and a lower out-of-pocket maximum than the Gold II California option.

He doesn’t mind paying more out of his paycheck to have a lower copayment when he and the kids see various providers. Before he commits, Eduardo calls his current insurance carrier to make sure that his family’s doctors are in network with the Gold option he’s considering.

While Eduardo is on the enrollment site, he renews his family’s dental and vision coverage, and makes sure that his life insurance beneficiary designation is up-to-date. Finally, Eduardo elects to contribute $1,000 to a flexible spending account for the braces his daughter needs next year.

Eduardo also considers group universal life insurance with long-term care provision, but because of the higher premiums for the Gold option, in addition to his plan to move in with his younger sister’s family in the Dominican Republic after he retires, he decides against it.

Maryam’s primary concern is her and Duwad’s high healthcare plan usage. She wants to reduce their out-of-pocket costs without sacrificing coverage.

To become proactive healthcare consumers, Maryam and Duwad take advantage of free preventive care. Duwad manages his high cholesterol by taking his medication and eating more vegetables from the garden he and Maryam are growing.

How can Maryam reduce her out-of-pocket costs while still covering her family’s high healthcare plan usage?

After years of Maryam’s nagging, Duwad has finally decided to go through their insurance carrier’s smoking cessation program. Last year, as part of his preventive visit, Duwad had a diabetic and lung cancer pre-screening for at-risk adults. Those tests showed elevated risks, so Duwad is ready to make a lifestyle change, including losing weight.

When Maryam enrolled for benefits last year, she considered the Platinum option but chose the Gold option. After reviewing her healthcare costs along with the premium, she selected the Gold because her annual cost would be lower. This year, with Duwad’s health concern, she wants to make sure that Gold is still the best option.

Duwad and Maryam start by going through their medical billing statements to see how they used their healthcare coverage this year.

They compare the Gold and Platinum options on the ABC InfoShare, looking at deductibles and out-of-pocket maximums for medical, dental and vision coverage. As part of their evaluation process, they also log on to the ABC to compare their premiums for each of the options.

Maryam and Duwad decide to stay in the Gold option. Maryam puts $50 per pay period into an FSA to pay for their monthly doctor appointments, prescriptions, and dental and vision visits.

Although the Platinum option has no deductible and a low out-of-pocket maximum, the premiums are very expensive. By looking closely at their statements on their insurance carrier’s website, they notice they didn’t reach the out-of-pocket maximum because they took advantage of in-network providers and generic medications. They decide to stay in the Gold option because the cost of their healthcare along with the premiums are still lower than the Platinum premiums.

Before she completes her benefits enrollment, Maryam renews her dental and vision coverage, and her Hospital Indemnity and Critical Illness plans. She’ll count on the cash payment from these optional coverages if she or Duwad has a health crisis. Finally, she double-checks that her life insurance beneficiary is up-to-date.

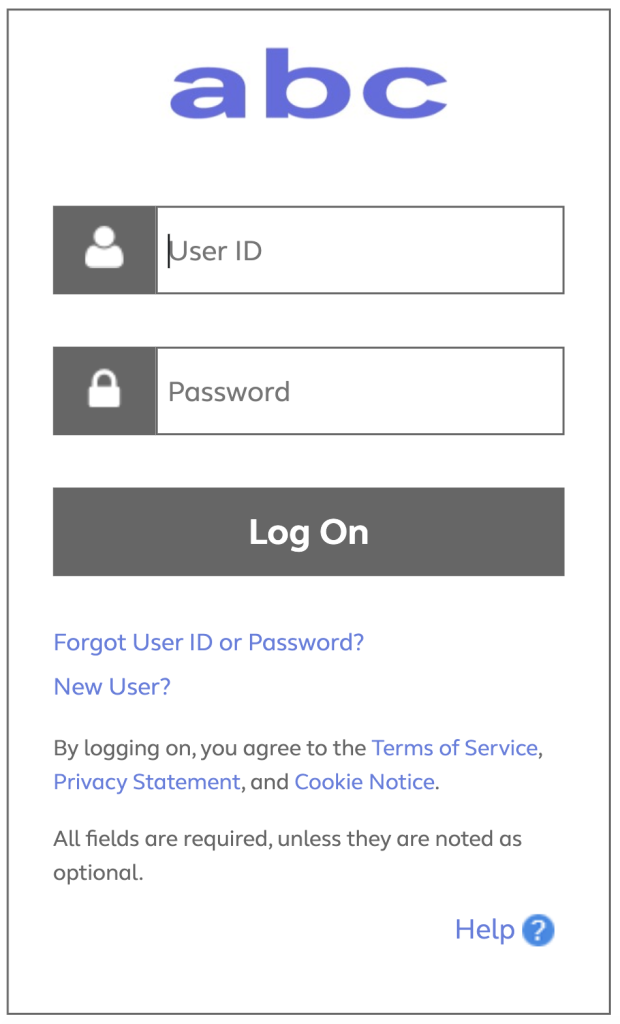

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.