I’m not feeling well, where should I go?

For options on where you can get care when you’re not feeling well.

The Bronze Plus option may be the right choice for you if:

You want low per-paycheck contributions, i.e., premiums.

And

You like predictability—to know exactly what you’ll pay when you see a provider or fill a prescription, i.e., copayments (copays).

Your Cost

How much you’ll pay for a medical option is a three-component equation:

|

1 What you pay to have coverage |

2 What you pay when you need care |

3 What you save for future healthcare needs |

|

|---|---|---|---|

|

Paycheck premiums |

Copayments (Copays) |

Deductible |

Healthcare savings |

|

Varies depending on ZIP code and coverage level |

Primary: $30 |

Employee only: $2,300 |

Flexible Spending Account |

|

|

|

|

A flexible spending account may be a smart way to manage your out-of-pocket healthcare expenses for the year. Just remember that you have to use the balance in your FSA annually or you forfeit the remainder. The Bronze Plus option offers you the same doctors as the Gold option, but with lower premiums and a higher deductible.

The Silver option may be the right choice for you if:

You want low per-paycheck contributions, i.e., premiums.

And

You don’t expect to use a lot of medical services, or you can easily afford an expense like an unexpected doctor’s visit or prescription.

And

You want to save money for healthcare expenses—including your deductible and coinsurance, as well as future needs—in a pretax Health Savings Account.

Your Cost

How much you’ll pay for a medical option is a three-component equation:

|

1 What you pay to have coverage |

2 What you pay when you need care |

3 What you save for future healthcare needs |

|

|---|---|---|---|

|

Paycheck premiums |

Copayments (Copays) |

Deductible |

Healthcare savings |

|

Varies depending on ZIP code and coverage level |

You must pay the total cost of your service until you reach the deductible |

Employee only: $1,700 |

Health Savings Account |

|

|

|

|

You might be wondering if the Silver option will serve your needs well if you have a lot of medical and prescription expenses. It will—when you maximize your HSA savings. Consider the example below, showing someone with $5,000 of medical expenses in a year under the Gold and Silver options.

Comparison of $5,000 Annual Expenses

|

Employee Only Coverage |

Gold Option (PPO) |

Silver Option (HDHP) |

|---|---|---|

|

12 months of premiums |

$2,470 |

$614 |

|

Annual deductible |

$800 |

$1,700 |

|

Coinsurance |

($5,000 – $800) * .20= $840 |

($5,000 – $1,700) * .25 = $825 |

|

Total spent Jan.-Dec. |

$4,110 |

$3,139 |

In this example, if you’re enrolled in the Silver option, you could pay your annual deductible plus coinsurance using pretax contributions you’ve saved in your HSA throughout the year.

Silver option features a “True Family” deductible. If you enroll in any coverage other than Employee only, the “Family” deductible must be met before cost-sharing begins for any covered individual.

A Health Savings Account is available only with the Silver option because it is a high-deductible health plan (HDHP).

are pretax (so your gross pay is lower for tax purposes, too)

accrues untaxed

Bottom line: If you need predictability in cost or don’t want to save money in an HSA, the Silver option probably will not be a good fit.

The Gold option may be the right choice for you if:

You want a low annual deductible in exchange for higher premiums.

And

You like predictability—to know exactly what you’ll pay when you see a provider or fill a prescription, i.e., copayments (copays).

Your Cost

How much you’ll pay for a medical option is a three-component equation:

|

1 What you pay to have coverage |

2 What you pay when you need care |

3 What you save for future healthcare needs |

|

|---|---|---|---|

|

Paycheck premiums |

Copayments (Copays) |

Deductible |

Healthcare savings |

|

Varies depending on ZIP code and coverage level |

Primary: $25 |

Employee only: $800 |

Flexible Spending Account |

|

|

|

|

A flexible spending account may be a smart way to manage your out-of-pocket healthcare expenses for the year. Just remember that you have to use the balance in your FSA annually or you forfeit the remainder.

California has two Gold options. The Gold II option is an HMO with only in-network benefits.

|

Gold |

Gold II |

|

|---|---|---|

|

PREVENTIVE CARE |

100% covered |

100% covered |

|

COPAYMENT (COPAY) Primary physician / Specialist |

$25 / $40 |

$25 / $40 |

|

DEDUCTIBLE Employee only / Family |

$800 / $1,600 |

None |

|

COINSURANCE |

20% |

30% |

|

out-of-pocket maximum |

$3,600 / $7,200 |

$5,400 / $10,800 |

|

HEALTHCARE ACCOUNT |

Flexible Spending Account optional |

Flexible Spending Account optional |

|

PRESCRIPTION |

||

|

Tier 1 |

$10 |

$10 |

|

MEDICAL OPTION |

Preferred Provider Organization (PPO) |

Health Maintenance Organization (HMO) Only in-network benefits |

The Platinum option may be the right choice for you if:

You don’t mind paying the highest premiums.

And

You like the predictability of copayments when you see a provider or fill a prescription.

Your Cost

How much you’ll pay for a medical option is a three-component equation:

|

1 What you pay to have coverage |

2 What you pay when you need care |

3 What you save for future healthcare needs |

|

|---|---|---|---|

|

Paycheck premiums |

Copayments (Copays) |

Deductible |

Healthcare savings |

|

Varies depending on ZIP code and coverage level |

Primary: $25 |

Employee only: $250 |

Flexible Spending Account |

|

|

|

|

A flexible spending account may be a smart way to manage your out-of-pocket healthcare expenses for the year. Just remember that you have to use the balance in your FSA annually or you forfeit the remainder.

|

Bronze Plus |

Gold |

Platinum |

Silver |

|

|---|---|---|---|---|

|

PREVENTIVE CARE |

100% covered |

100% covered |

100% covered |

100% covered |

|

PREMIUMS Rates depend on ZIP code and coverage level |

$ |

$$ |

$$$ |

$ |

|

COPAYMENT PCP / Specialist |

$30 / $50 |

$25 / $40 |

$25 / $40 |

You pay the cost of visit until deductible is met |

|

URGENT CARE |

$50 |

$40 |

$25 |

None |

|

DEDUCTIBLE Employee only / Family |

$2,300 / $4,600 |

$800 / $1,600 |

$250 / $500 |

$1,700 / $3,400 |

|

COINSURANCE |

30% |

20% |

15% |

25% |

|

Out-of-pocket maximum |

$6,700 / $13,400 |

$3,600 / $7,200 |

$2,300 / $4,600 |

$4,250 / $8,500 |

|

HEALTHCARE ACCOUNTS Flexible Spending Account Health Savings Account |

FSA optional HSA not available |

FSA optional HSA not available |

FSA optional HSA not available |

Dental and vision FSA optional HSA available |

|

PRESCRIPTION Copayment |

||||

|

Tier 1 |

$12 |

$10 |

$8 |

No copayments |

For options on where you can get care when you’re not feeling well.

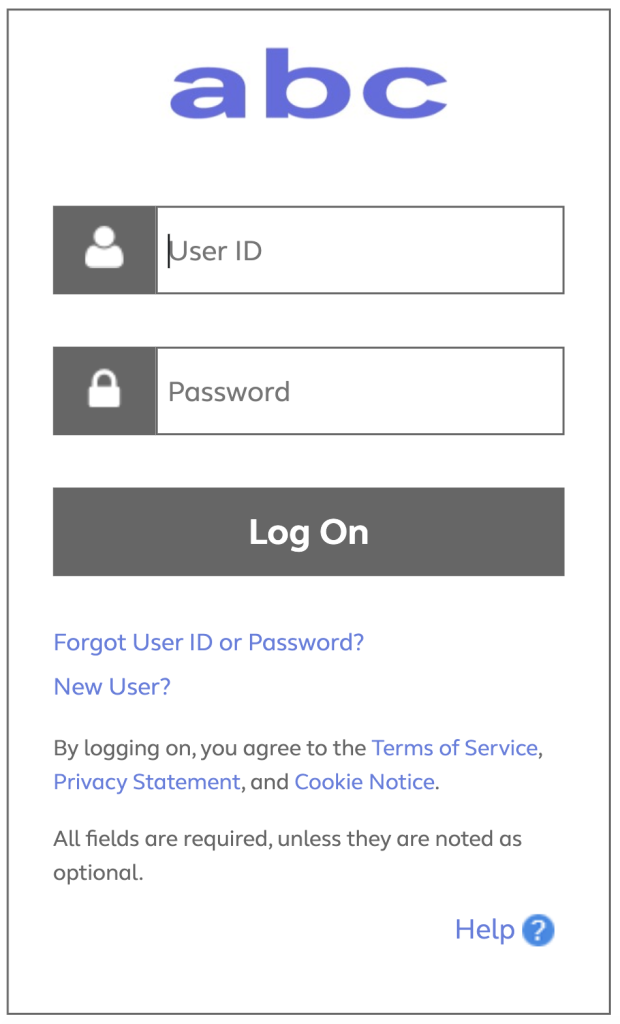

Heads up! You are leaving the ABC InfoShare. Unless you’re on the Asurion network, you’ll need your username and password to access Asurion Benefits Central at asurion.benefitsnow.com. Only current Asurion employees may log in.

If you don’t have the required log-in details, select Forgot User ID or Password? and follow the prompts. If this is your first visit to Asurion Benefits Central, click New User?

Questions: Call 844.968.6278.

Register in Asurion Learning for the meeting you’d like to attend. After registering, you’ll receive a confirmation email containing information about joining the meeting.